2025

PREPARED BY

info@kaden.nyc

www.kaden.nyc

One World Trade Center Ste 8500 New York, NY 10007 KADEN

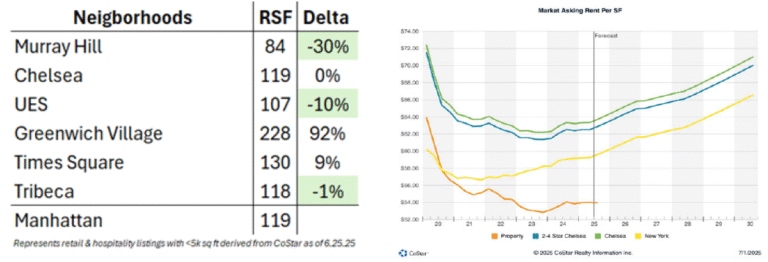

Prime Manhattan restaurant corridors (West Village, SoHo, Flatiron) remain slightly below 2019 peak rents, but momentum is building

Key Market Trends

• Prime Manhattan restaurant corridors (West Village, SoHo, Flatiron) remain slightly below 2019

peak rents, but momentum is building

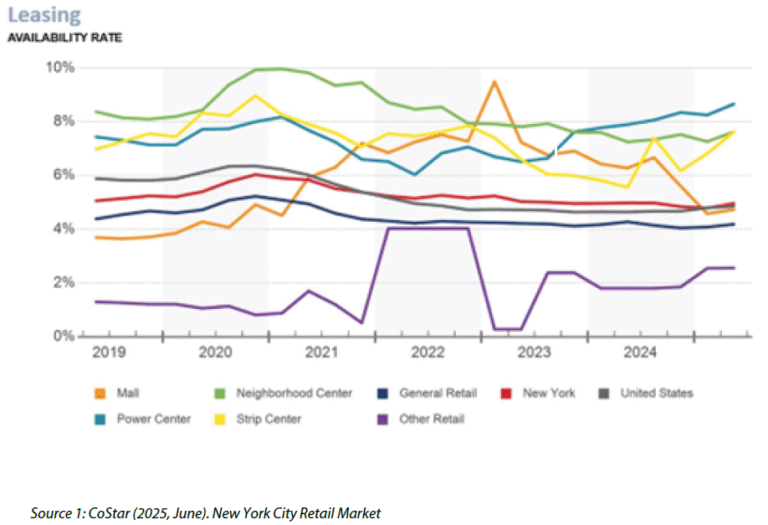

• Retail availability is shrinking, especially for vented and turnkey restaurant spaces

• Neighborhood corridors in Brooklyn (Williamsburg, Bushwick, Bed-Stuy) and Queens (Astoria,

Ridgewood) are driving F&B growth

• As a result, greater lease flexibility and discounts to the asking rents are said to be applied across

many deals

Opportunity Zone

• West Village: Strong legacy tenant activity, rare second-gen space

• Bushwick: Top submarket for chef-driven concepts and hybrid models

• 5th Ave (Midtown): $350M streetscape overhaul to boost foot traffic & appeal

• Greenpoint/Ridgewood: Balanced price and exposure with rising demand

Why Lease Now:

• Core F&B corridors are leasing up and prime inventory is disappearing

Operators who embrace strategic decision-making—whether through tax planning, conversions, or optimized leasing—will be the ones who thrive.

1. What do I need to know to unlock Tax & Zoning Benefits? Maximize conversions with tax breaks, abatements, and regulatory advantages.

2. How do I ‘Convert Smart, Lease Smart’? Structure conversions to optimize leasing terms and long-term revenue.

3. Would it hurt to capitalize on Brooklyn & Queens Growth? Invest where demand is surging and rental rates remain strong.

4.What’s my Greatest Obtainable Market Q1&2? Maximize Market Share. Target the most profitable segment—20% of the obtainable market.

Kaden brings deep market knowledge and expertise to complex transactions, addressing all landlord challenges under one roof.

(212) 729 3526

bledar@kaden.nyc

(917) 808 9495

ben@kaden.nyc

One World Trade Center Ste 8500 New York, NY 10007

www.kaden.nyc info@kaden.nyc

Source 1: CoStar (2025, June). New York City Retail Market

Source 2: Page Six (2025). Drai’s brining supper club to NYC that serves $1k caviar

Source 3: CoStar (2025)