2025

PREPARED BY

info@kaden.nyc

www.kaden.nyc

One World Trade Center Ste 8500 New York, NY 10007 KADEN

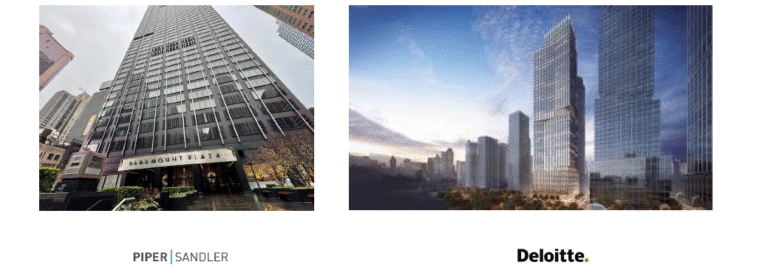

Manhattan recorded 3.7mm SF of new leases in August 2025, more than 20% above July’s pace.

Major deals include Deloitte’s ~800k SF pre-lease at 70 Hudson Yards and Piper Sandler’s 140k SF

lease at 1301 Sixth Avenue (Paramount Plaza). These commitments confirm that large blocks are

still being absorbed by blue-chip tenants.

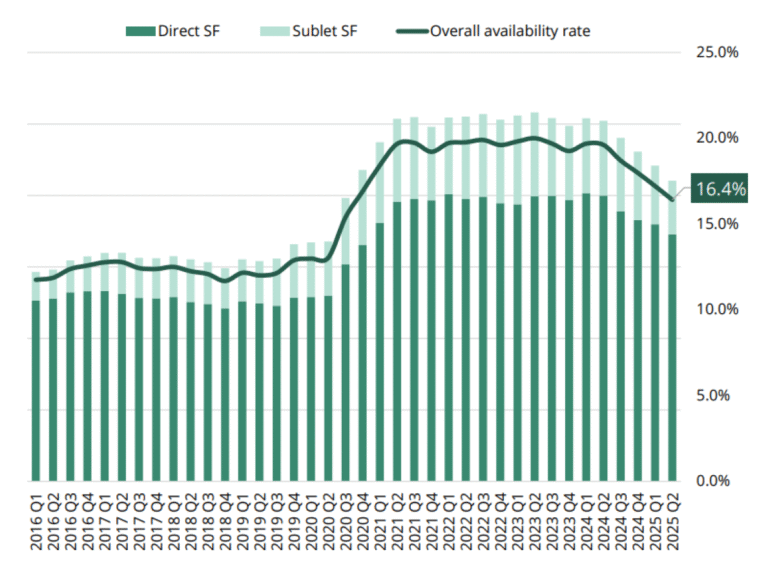

• Avison Young reports Manhattan’s

overall availability rate fell to 16.4% in Q2

2025 — the lowest in more than four

years. Lower supply typically translates to

stronger landlord leverage and tightening

concessions in quality assets.

Source 1: Avison Young Market Intelligence

Retail Hits Cycle Lows

• Cushman & Wakefield data show prime retail availability dropped to 12.8% across 11 premier

corridors — the tightest since 2014. Combined with stronger retail sales and foot traffic, investors

in core retail assets are realizing 6–12%+ IRR targets in stabilized properties.

Restaurants under Margin Pressure

Industry benchmarks show full-service restaurants net ~3–5%, while quick-service / fast-casual

achieve 6–9%. Digital channels are key: Square finds first-party online ordering delivers ~64%

higher margins than third-party platforms, underscoring the value of controlling your digital

infrastructure in booking catering opportunities.

Capital flows to Real Assets

• Institutional investors have rotated capital away from an oversupplied VC/tech market into

real assets (real estate, infrastructure, natural resources). BlackRock commentary notes

improved relative performance in 2024–2025 as allocators sought yield and inflation protection.

•We expect continued resilience in leasing and retail into late 2025. That said, we advise clients

to prepare for potential re-pricing in 2026 as rates, cap rates, and global liquidity reset. Our

house view models a 10–20% decline in the benchmark (S&P 500) correction scenario.

Source 2: Restroworks (2025). Restaurant Profitability Statistics: Startup Performance, Margins & Industry Benchmarks — Restroworks Blog

Source 3: BusinessWire (2025). Square Data Shows How 2025’s Economic Volatility Is Impacting the Restaurant Industry

Source 4: BlackRock (2025). 2025 Private Markets Outlook — BlackRock Institutional Insights

Source 5: Cushman & Wakefield (2025). Q2 Manhattan Retail Report

Operators who embrace strategic decision-making—whether through tax planning,

conversions, or optimized leasing—will be the ones who thrive.

1. What do I need to know to unlock Tax & Zoning Benefits? Maximize

conversions with tax breaks, abatements, and regulatory advantages.

2. How do I ‘Convert Smart, Lease Smart’? Structure conversions to optimize leasing terms and long-term revenue.

3. Would it hurt to capitalize on Brooklyn & Queens Growth? Invest where demand is surging and rental rates remain strong.

4.What’s my Greatest Obtainable Market Q1&2? Maximize Market Share. Target the most profitable segment—20% of the obtainable market.

Kaden brings deep market knowledge and expertise to complex transactions, addressing all landlord challenges under one roof.

(212) 729 3526

bledar@kaden.nyc

(917) 808 9495

ben@kaden.nyc

One World Trade Center Ste 8500 New York, NY 10007

www.kaden.nyc info@kaden.nyc