2025

PREPARED BY

info@kaden.nyc

www.kaden.nyc

One World Trade Center Ste 8500 New York, NY 10007 KADEN

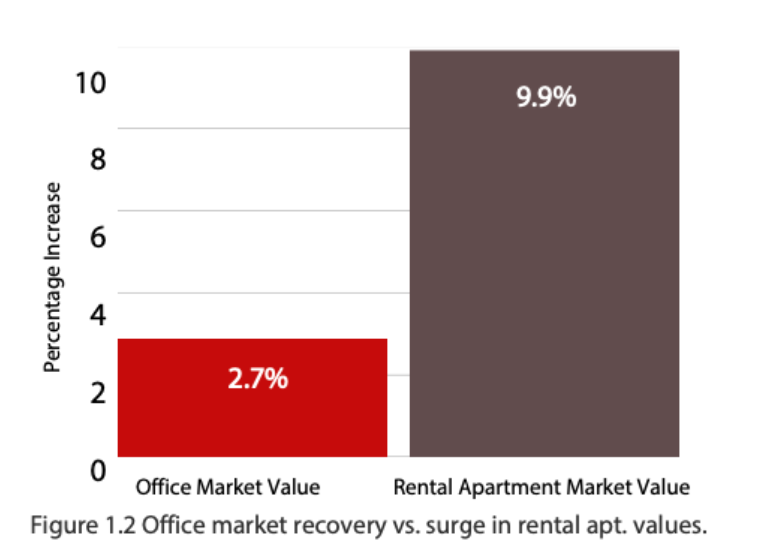

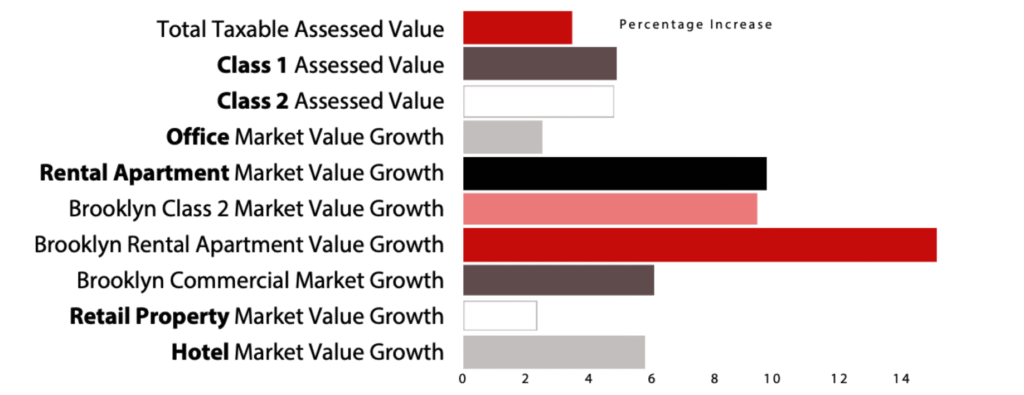

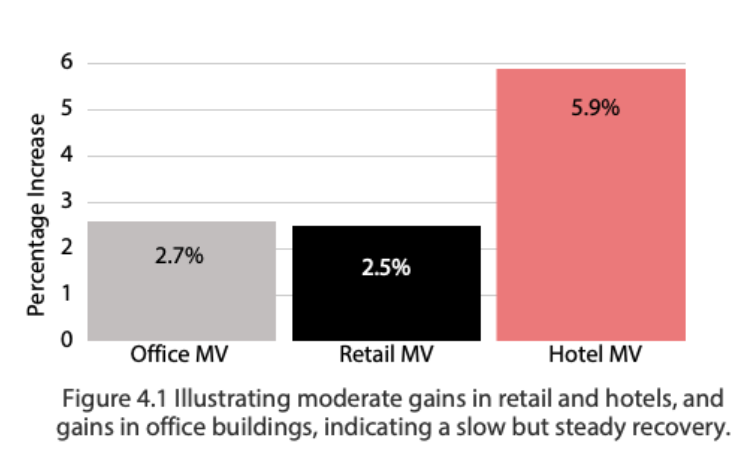

The office sector’s total market value increased by 2.7% while rental apartment market values raised to 9.9%, highlighting greater demand for residential properties.

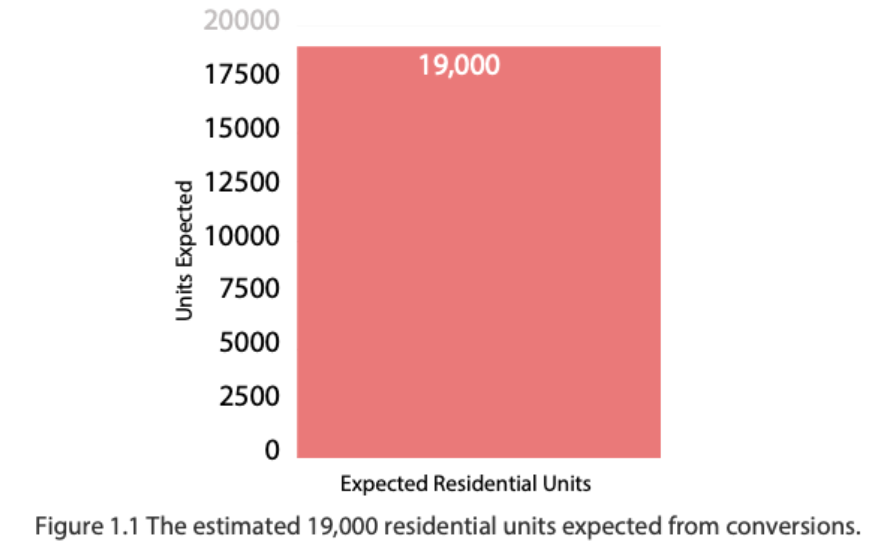

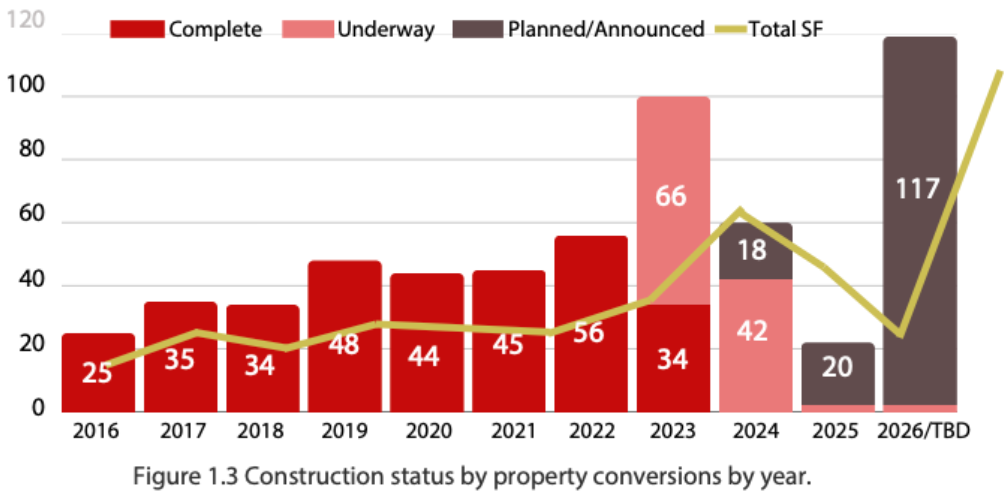

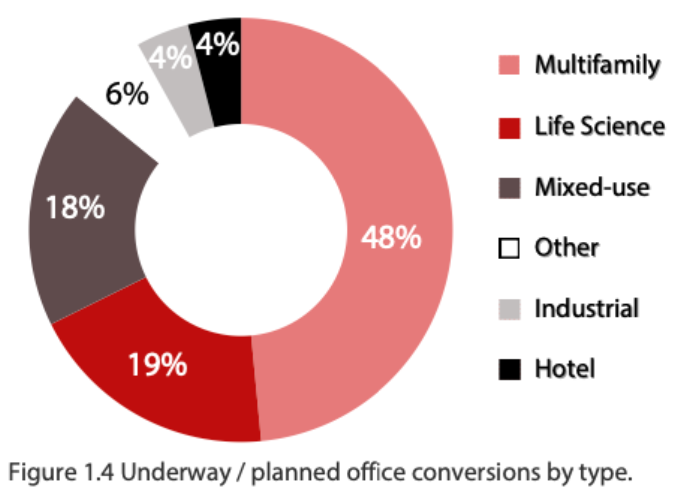

NYC’s latest initiatives aim to convert underutilized office spaces, Office to Rental Conversions (OTRC), into nearly 19,000 residential units over the next eight (8) years.

The total taxable assessed value in NYC increased by 3.9% to $311.2 billion, meaning property owners will see higher tax bills in FY 26.

Class 1 (single-family) saw a 5.5% increase in assessed value, reaching $27.2 billion, while Class 2 (multi) grew by 4.8% to $120.7 billion.

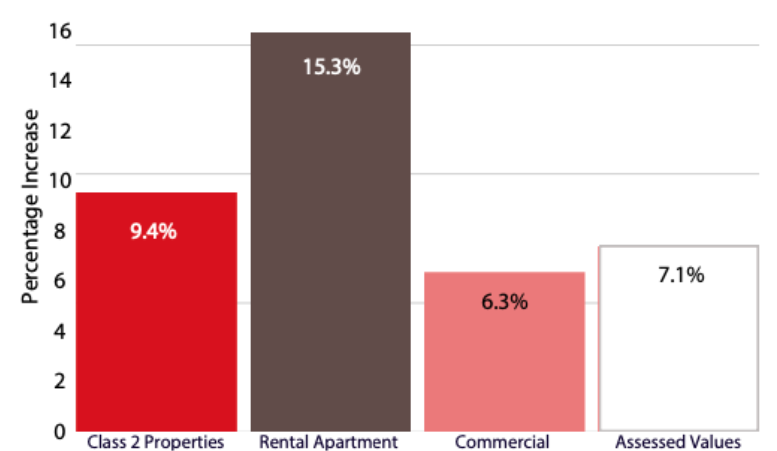

Brooklyn had the highest market value increase for Class 2 properties and led the city with a 15.3% increase in rental apartment values.

The borough’s commercial market also outpaced others with a 6.3% increase in total market value and a 7.1% jump in assessed values.

Figure 3.2 Property value increases across Class 2 properties, rental apartments, commercial market values, & assessed values.

i. Institutional Demand: Strong appetite for premium multifamily

assets, even in tough markets.

ii. Collaborative Win: Eastdil, RBC, Santander, and SMBC navigated

a complex deal with precision. Well done to the team!

Operators who embrace strategic decision-making—whether through tax planning, conversions, or optimized leasing—will be the ones who thrive.

1. What do I need to know to unlock Tax & Zoning Benefits? Maximize conversions with tax breaks, abatements, and regulatory advantages.

2. How do I ‘Convert Smart, Lease Smart’? Structure conversions to optimize leasing terms and long-term revenue.

3. Would it hurt to capitalize on Brooklyn & Queens Growth? Invest where demand is surging and rental rates remain strong.

4.What’s my Greatest Obtainable Market Q1&2? Maximize Market Share. Target the most profitable segment—20% of the obtainable market.

Kaden brings deep market knowledge and expertise to complex transactions, addressing all landlord challenges under one roof.

(212) 729 3526

bledar@kaden.nyc

(917) 808 9495

ben@kaden.nyc

One World Trade Center Ste 8500 New York, NY 10007

www.kaden.nyc info@kaden.nyc

Avison Young. (2024). Q4 2024 U.S. office market overview. Retrieved from https://www.avisonyoung.us/us-office-market-overview Bisnow. (2025, January). New York City real estate valued at $ 1.56T. Retrieved from https://www.bisnow.com/new-york/news/commercial-real-estate/new-york-city-real-estate-valued-at-156t-127588 CBRE. (2023). Rise in office conversions may help to reinvigorate cities. Retrieved February 5, 2025 from https://www.cbre.com/nsights/briefs/rise-in-office-conversions-may-help-to-reinvigorate-cities New York Post. (2025). New state and city measures are spurring property owners to turn obsolete office buildings into modern apartments. https://nypost.com/2025/01/29/real-estate/office-to-apartment-conversions-booming-nyc-thanks-to-new-city-measures/ Rosenberg & Estis. (2024, July). NYC Budget 2024/2025 and Property Tax Updates. Retrieved from ttps://www.rosenbergestis.com/blog/2024/07/nyc-budget-2024-2025-and-property-tax-updates/

New York City Real Estate values rise ~6% with rental apartments leading the charge. The office sector’s total market value increased by 2.7% while rental apartment market values raised to 9.9%, highlighting greater demand for residential properties. NYC’s latest initiatives aim to convert underutilized office spaces, Office to Rental Conversions (OTRC), into nearly 19,000 residential units over the next eight (8) years.

To download this report: Kaden Q1 2025 Market Update Report